HSBC BankPinnacle Wealth Planning

Senior UX Designer

Wealth planning for the ultra rich

Tapping into mainland China with the promise of quality investments backed by foreign banks

Overview

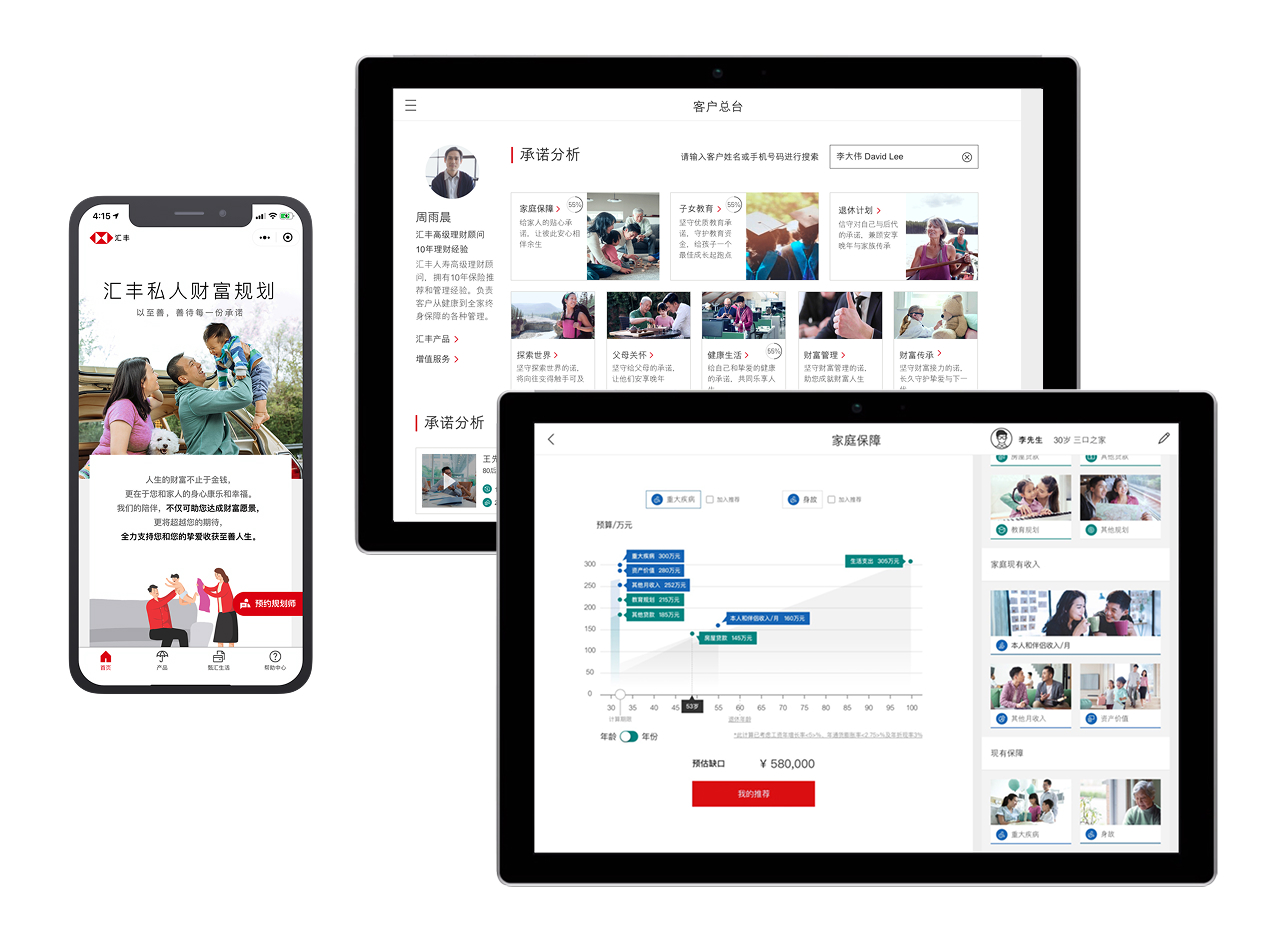

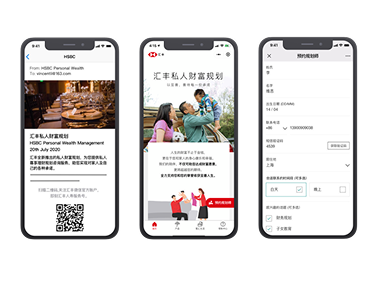

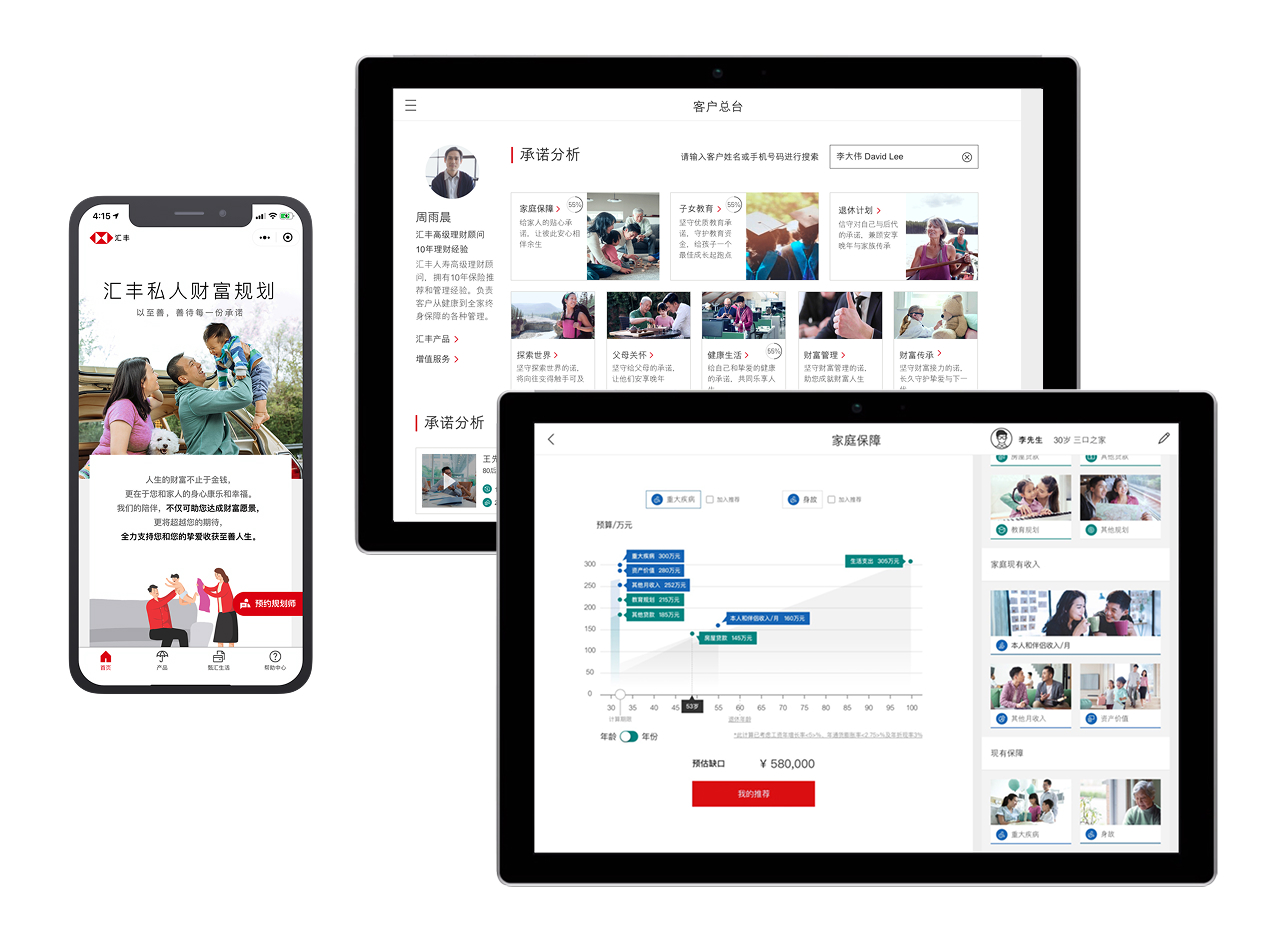

In 2020, HSBC seized an opportunity to expand into mainland China’s wealth management market by launching Pinnacle Venture—a bespoke insurance and investment platform. After acquiring full ownership of its joint venture, HSBC started on its plan to grow its portfolio of high-net-worth Non-Resident Chinese (NRCs) - riding on their track record of trustworthy foreign-backed, long-term wealth solutions.I was one of an in-house team of six global designers (Hong Kong/Guangzhou based) working alongside five other mainland China designers (Shanghai based) who were brought onboard to help create an E2E journey that consisted of three main parts:

- Acquisition (on/off-site events/referrals/WeChat integration),

- Financial Analysis and Recommendation (engagement and analysis)

- ACT (Application process).

The key user journeys I owned within the UX team were:1. Acquisition - Designed the sign-up experience to convert prospects into Pinnacle clients2. Financial Analysis & Recommendation - Crafted the post-meeting journey where Financial Planners analyse client needs and generate tailored wealth plans

Role:

UX/UI Designer

User research

System audit

Prototyping

User testing

Usability testing

Team:

Product ownersBusiness analystSolution architectFull stack devs

Software tester

Stakeholders

Duration:

6 months

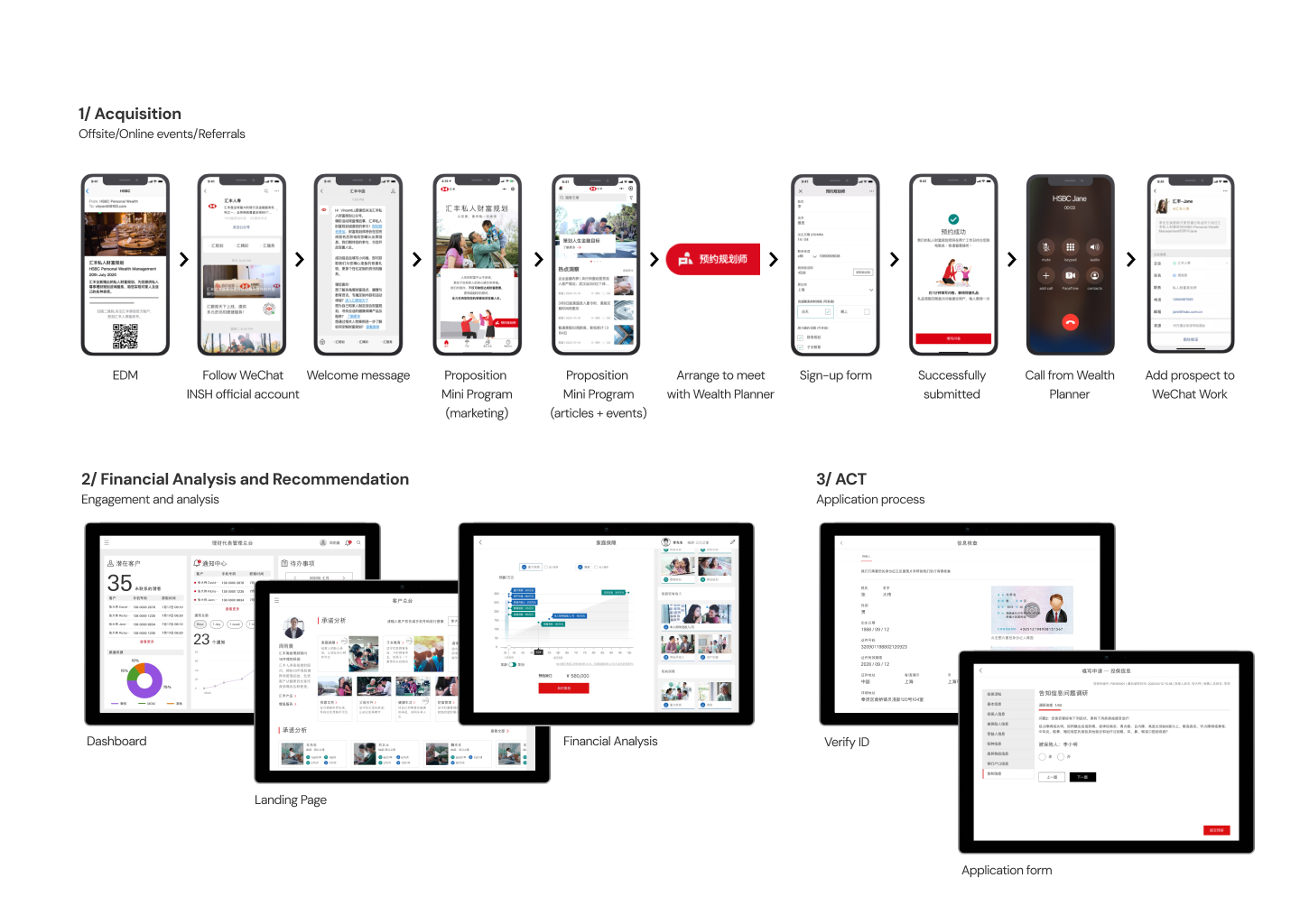

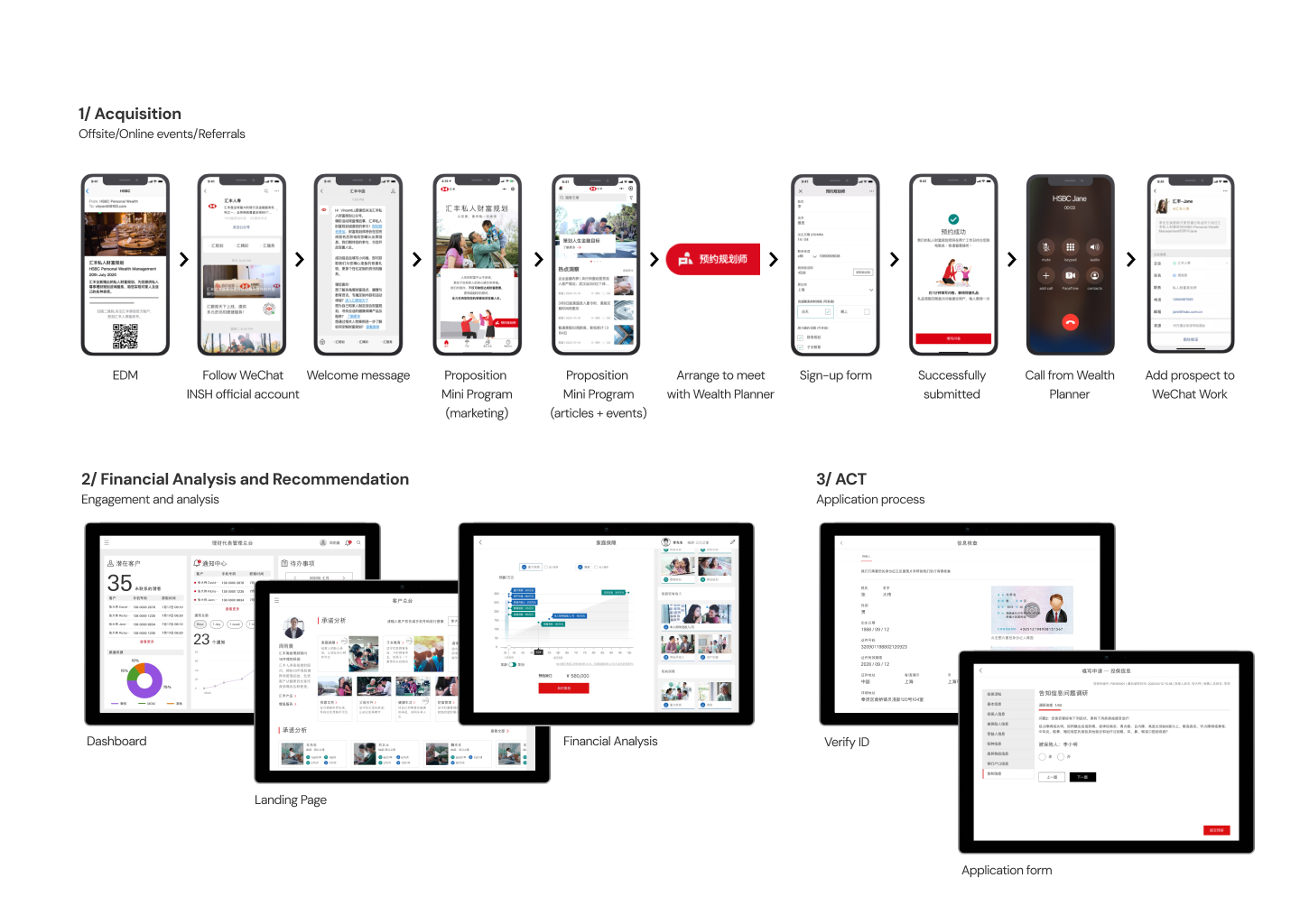

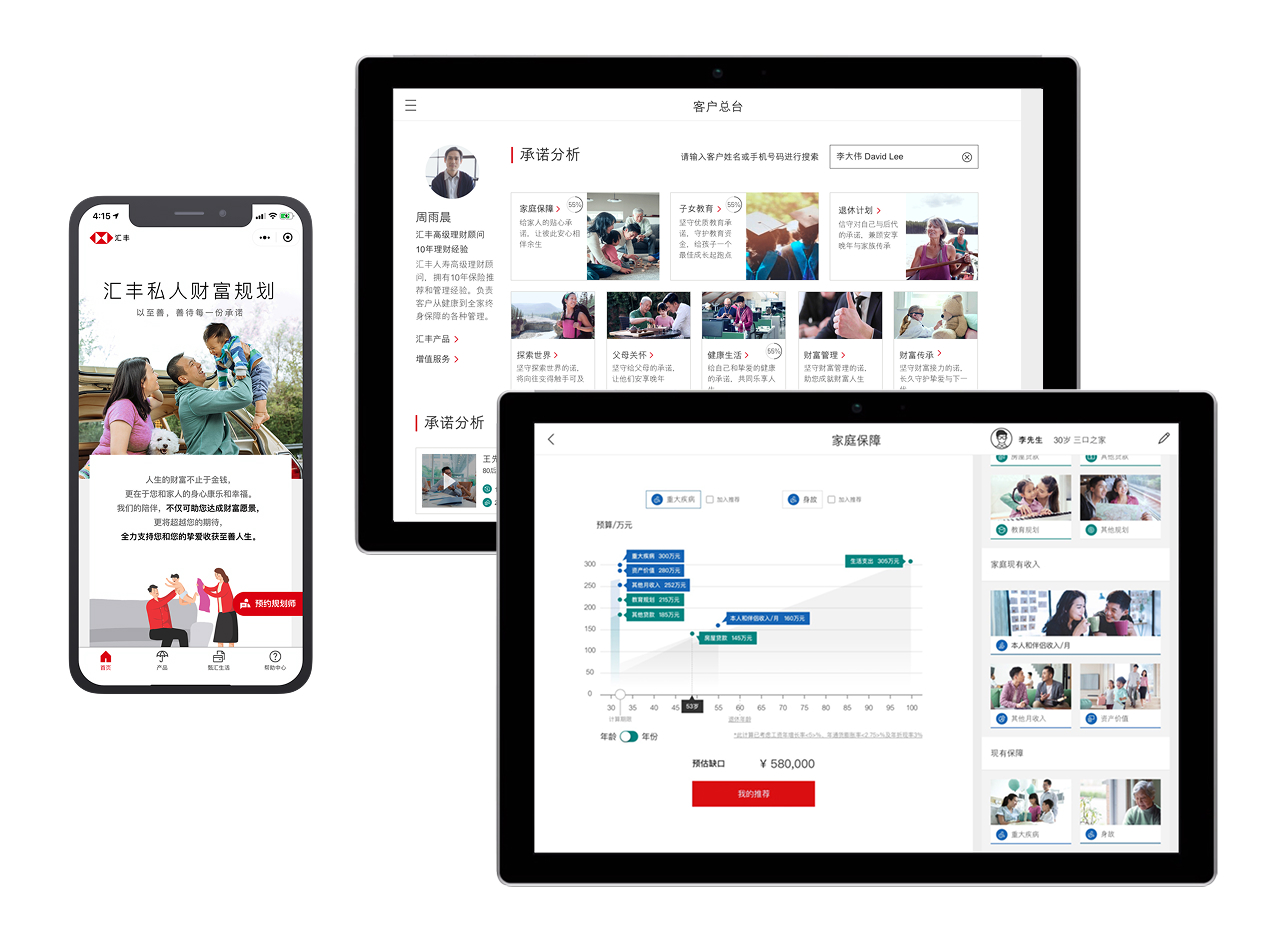

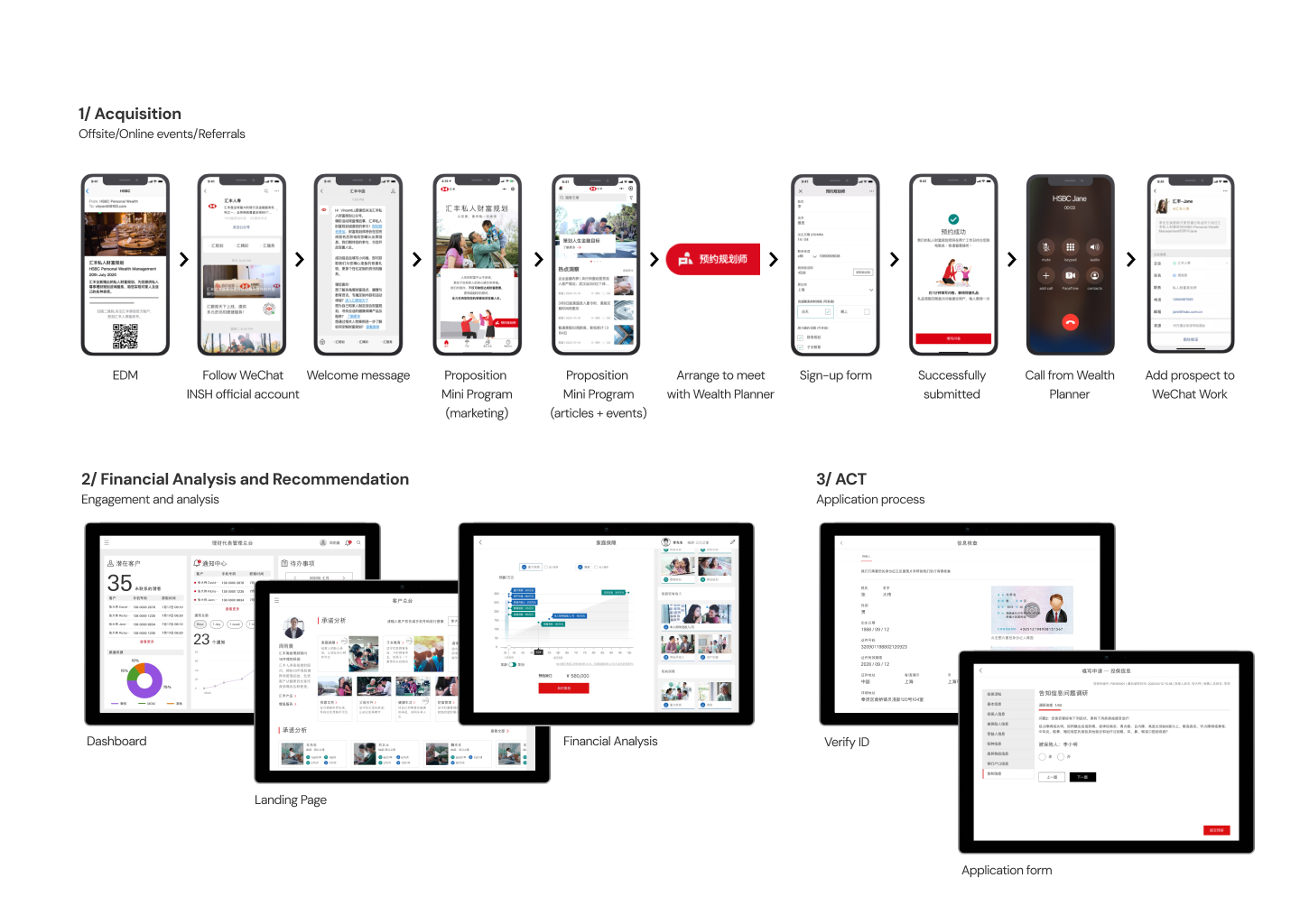

Pinnacle E2E journey

The three phases of the Pinnacle program starting from offsite/online events through to the application process

Acquisition

- Offsite/Online events

- EDM

- Official WeChat account

- 2 x WeChat Mini Programs

Financial Analysis

- Engagement

- Analysis

- Proposal

- Financial Analysis report

ACT

- EKYC

- Application form

- Underwriting

- Payment

- Discover

Research and feedback revealed these key issues:After the initial MVP launch, feedback for all three stages of the E2E journey had met with the following issues:

AcquisitionThe form was too long and text heavy. It was also overly complicated to fill in especially during online events where the FP wasn’t readily available.

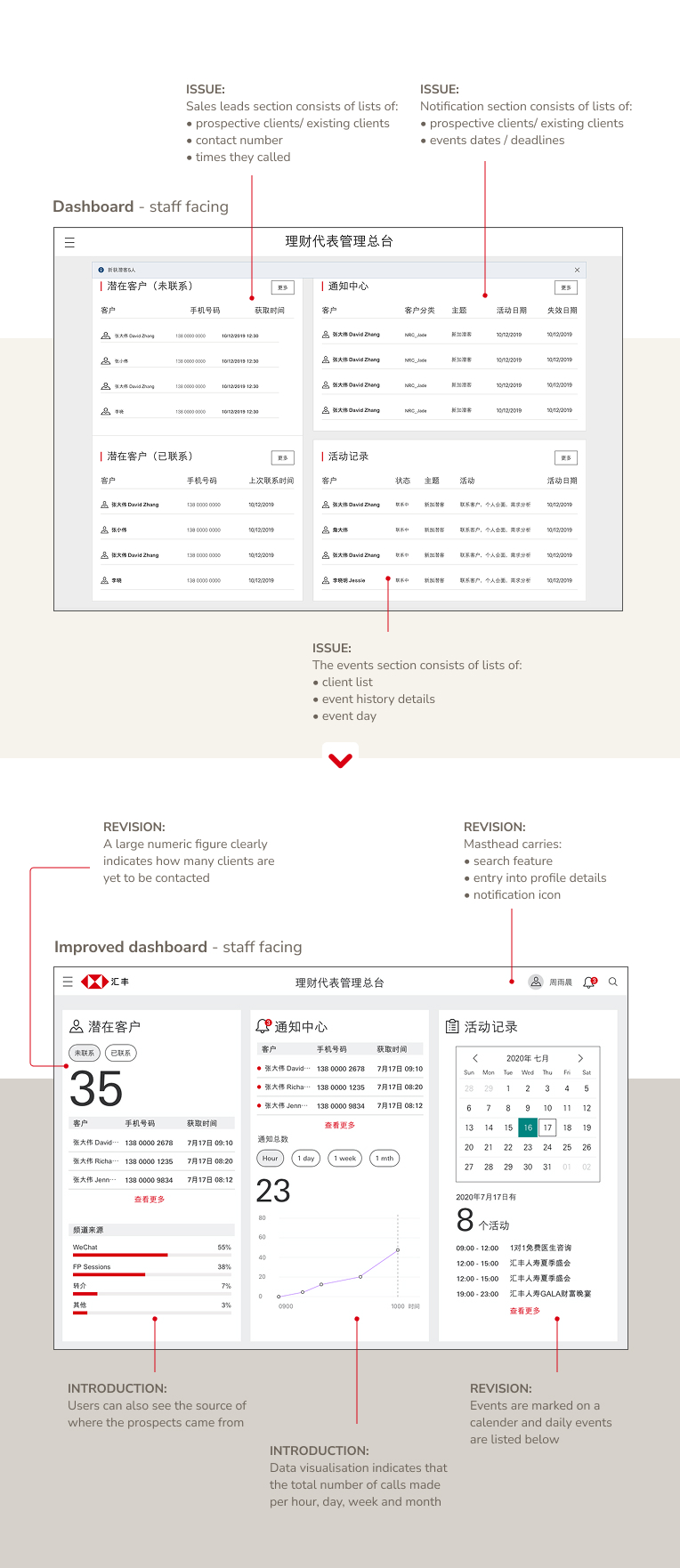

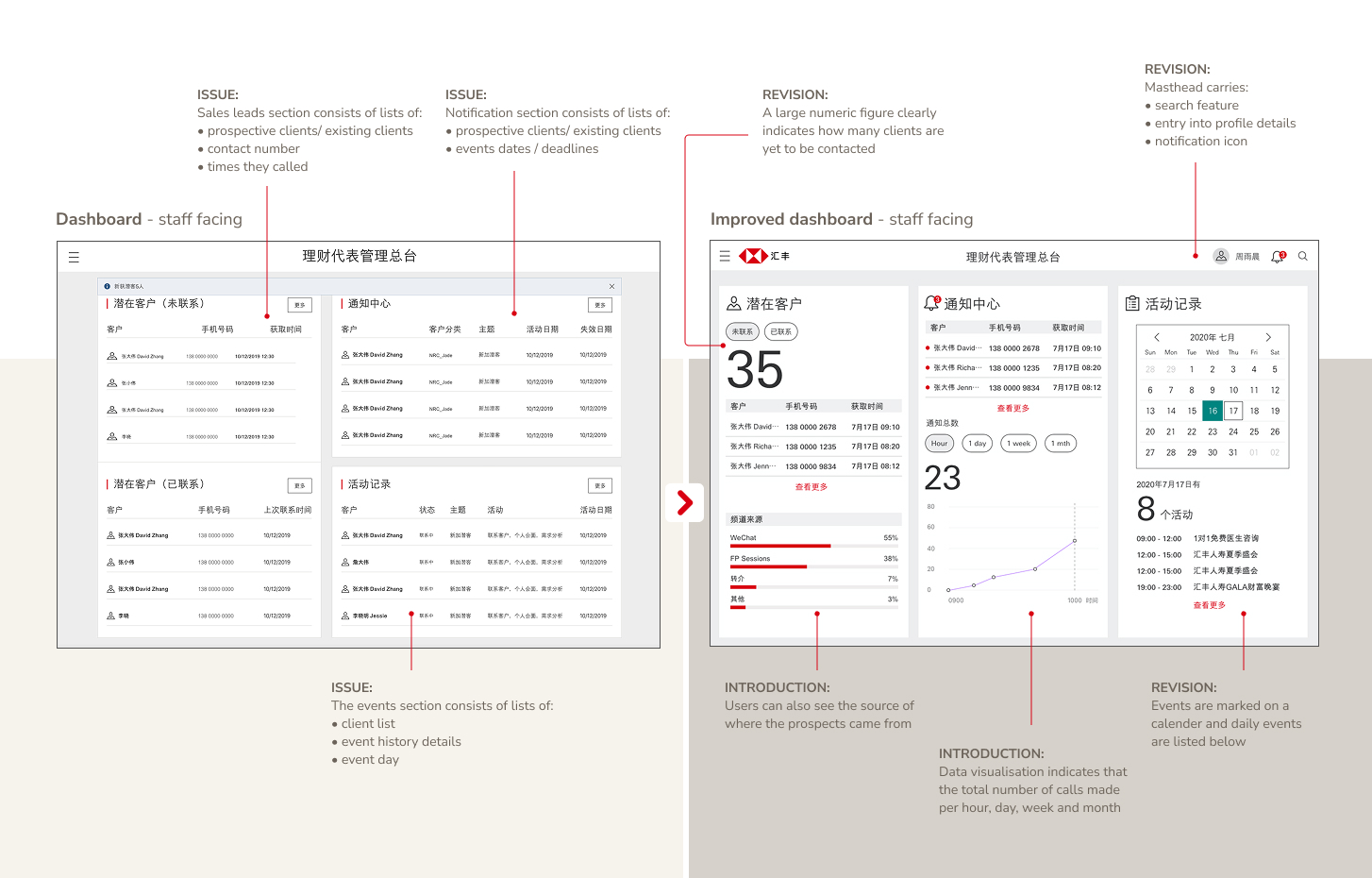

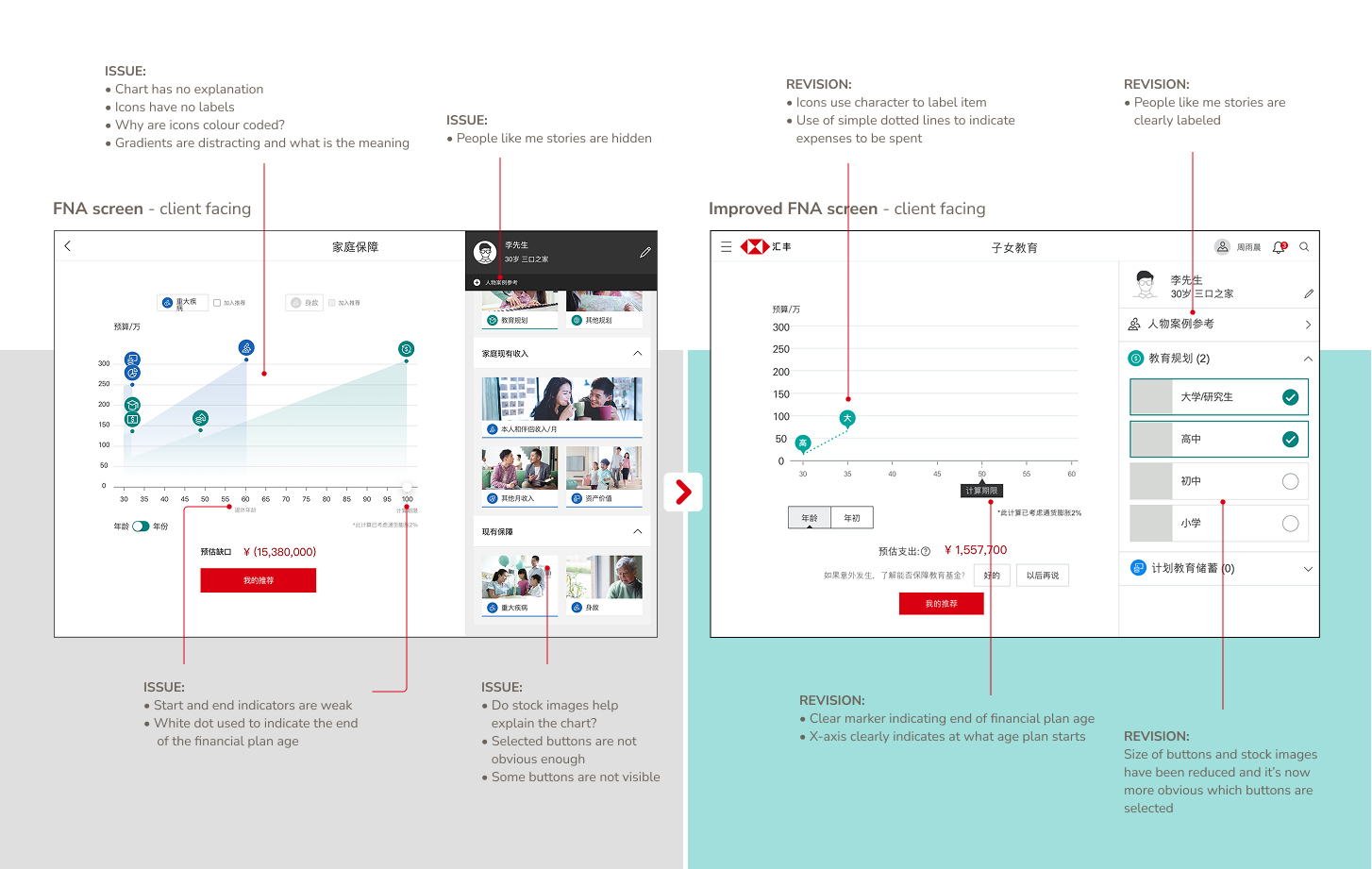

Financial AnalysisThe charts were difficult to read and understand with unintuitive interface. The data on the dashboard also wasn’t targeted and didn’t encourage competitiveness within the team.

ACT

The process was too long and involved much repetitive inputs such as asking for the addresses numerous times within the same form.

Redesign Goals

To improve the overall experience of the E2E journey by:

- Acquisition - enhance the form-filling experience by making it more engaging and providing clearer explanations of unfamiliar financial terms

- Financial Analysis - enhance the client meeting experience by refining interfaces—such as charts, printouts and the sales dashboard—to deliver better sales data for better competition engagement

- ACT - update form layouts and enhanced data collection methods to shorten the length of the form

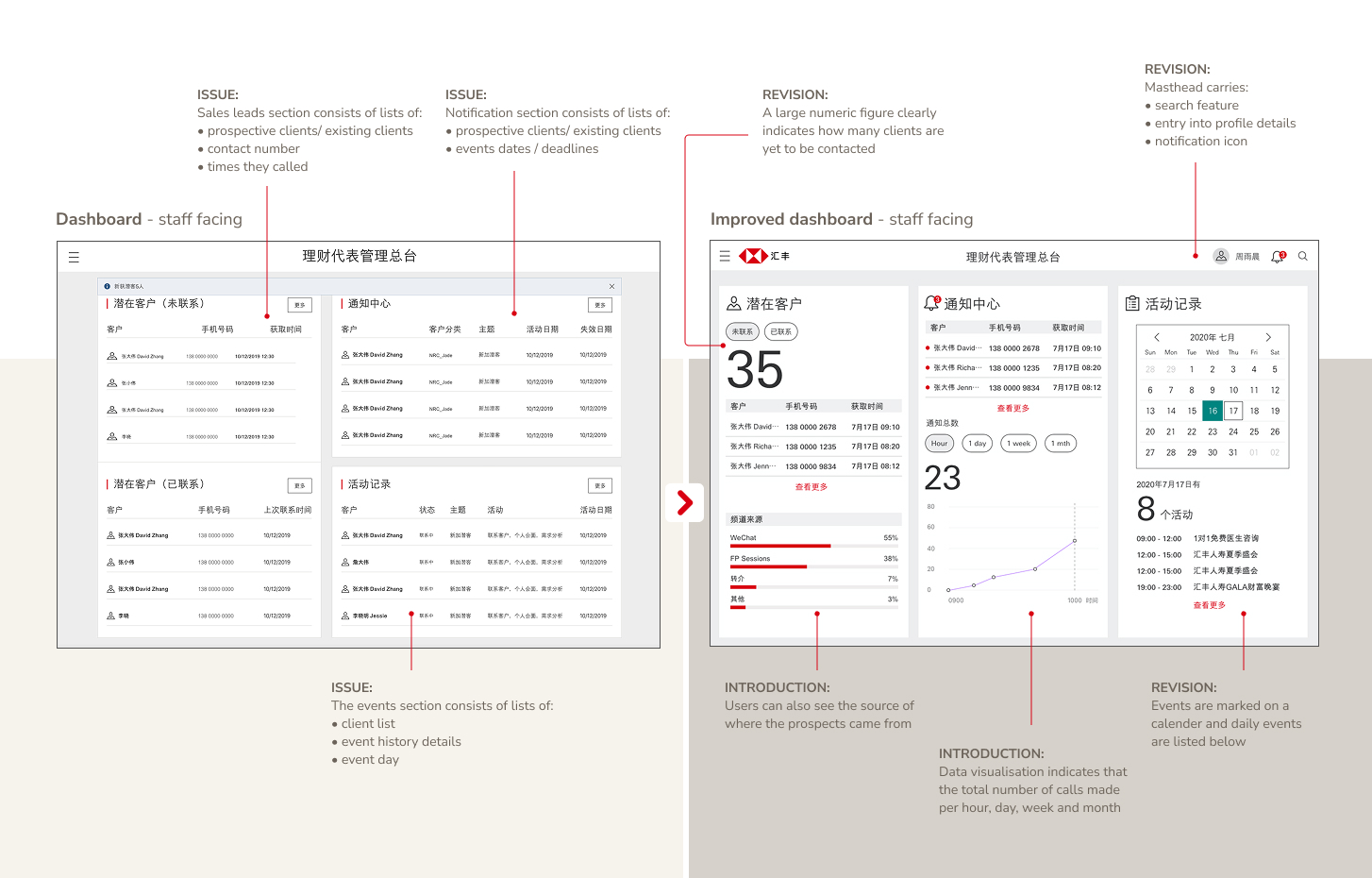

Improvements to the staff facing dashboard

Sharper data visuals that reveal key trends to boost sales performance

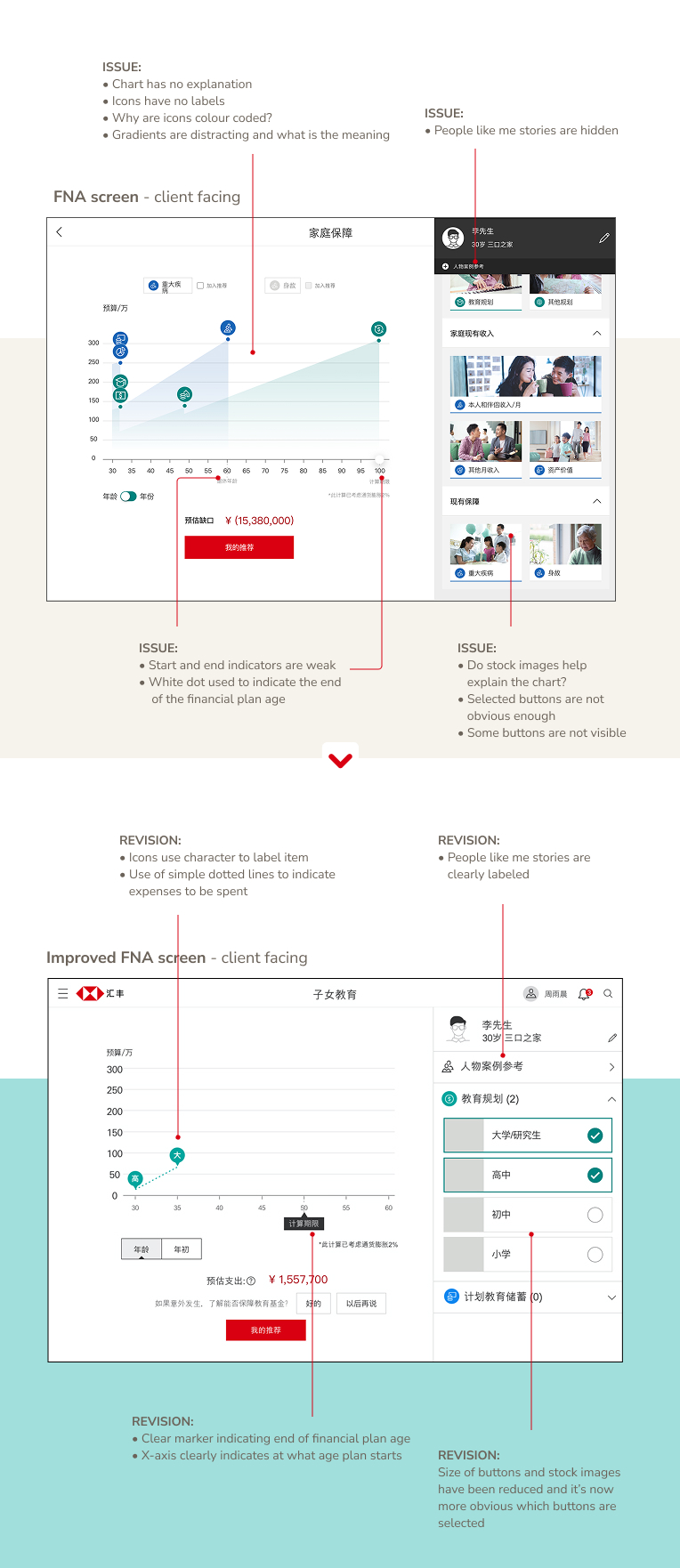

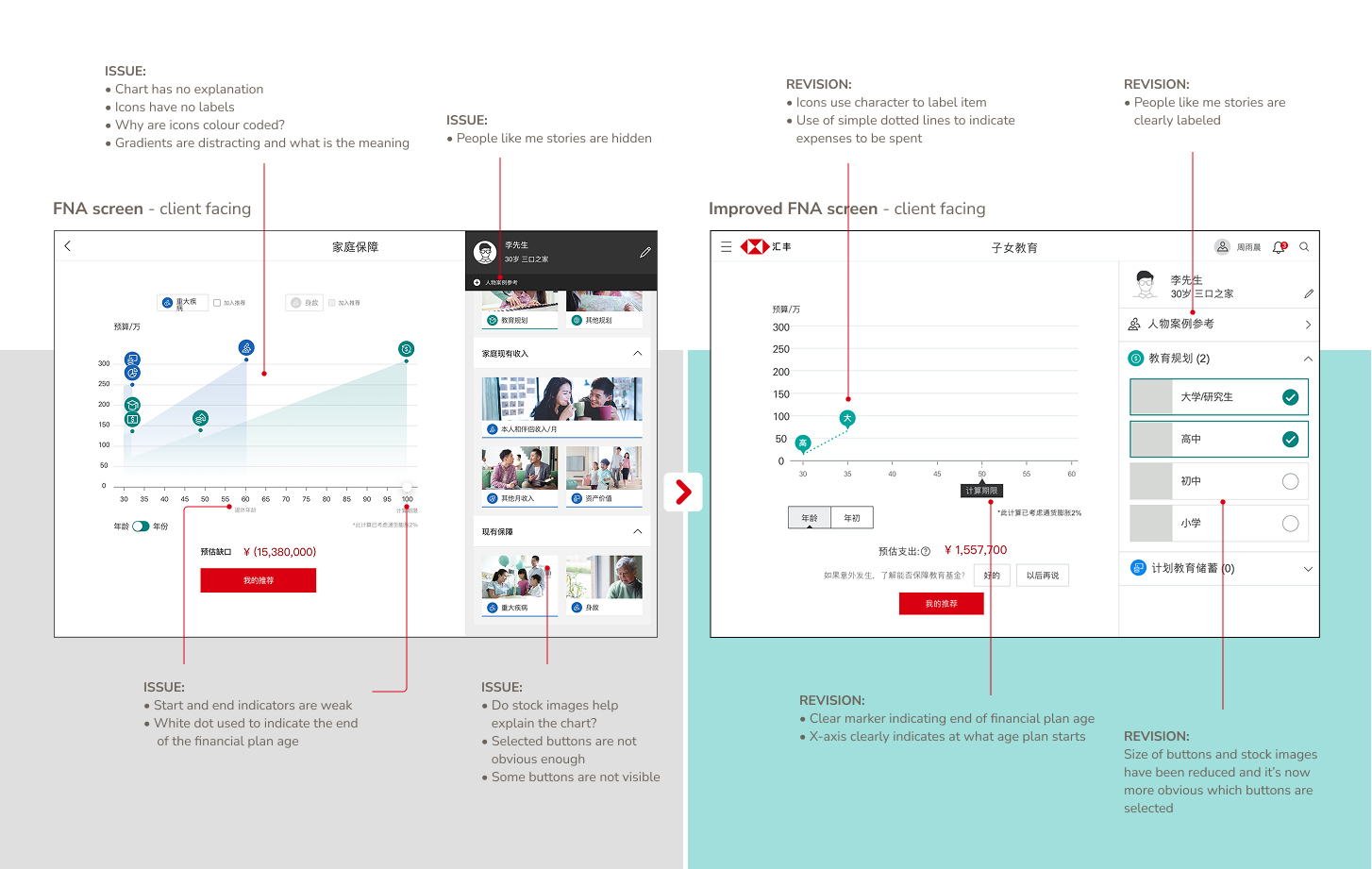

Improvements to the main FNA screen

Clearer labelling and visual indicators for selected sections for client facing screens

Next steps

To advance this development phase, I will conduct usability testing with Financial Planners to validate the effectiveness of these proposals. Following this, we will proceed with iterative refinements and further development. This structured approach will drive meaningful improvements in client engagement and sales performance during the next evolution of the Acquisition and Financial Analysis stage.

HSBC BankPinnacle Wealth Planning

Senior UX Designer

Wealth planning for the ultra rich

Tapping into mainland China with the promise of quality investments backed by foreign banks

Overview

In 2020, HSBC seized an opportunity to expand into mainland China’s wealth management market by launching Pinnacle Venture—a bespoke insurance and investment platform. After acquiring full ownership of its joint venture, HSBC started on its plan to grow its portfolio of high-net-worth Non-Resident Chinese (NRCs) - riding on their track record of trustworthy foreign-backed, long-term wealth solutions.I was one of an in-house team of six global designers (Hong Kong/Guangzhou based) working alongside five other mainland China designers (Shanghai based) who were brought onboard to help create an E2E journey that consisted of three main parts:

- Acquisition (on/off-site events/referrals/WeChat integration),

- Financial Analysis and Recommendation (engagement and analysis)

- ACT (Application process).

The key user journeys I owned within the UX team were:1. Acquisition - Designed the sign-up experience to convert prospects into Pinnacle clients2. Financial Analysis & Recommendation - Crafted the post-meeting journey where Financial Planners analyse client needs and generate tailored wealth plans

Role:

UX/UI Designer

User research

System audit

Prototyping

Team:

3 Product ownersSolution architectFull stack devs

Software testersStakeholders

Duration:

6 months

Pinnacle E2E journey

The three phases of the Pinnacle program starting from offsite/online events through to the application process

Acquisition

- Offsite/Online events

- EDM

- Official WeChat account

- 2 x WeChat Mini Programs

Financial Analysis

- Engagement

- Analysis

- Proposal

- Financial Analysis report

ACT

- EKYC

- Application form

- Underwriting

- Payment

- Discover

Research and feedback revealed these key issues:After the initial MVP launch, feedback for all three stages of the E2E journey had met with the following issues:

- Acquisition - The form was too long and text heavy. It was also overly complicated to fill in especially during online events where the FP wasn’t readily available

- Financial Analysis - The charts were difficult to read and understand with unintuitive interface. The data on the dashboard also wasn’t targeted and didn’t encourage competitiveness within the team.

- ACT - The process was too long and involved much repetitive inputs such as asking for the addresses numerous times within the same form

Redesign Goals

To improve the overall experience of the E2E journey by:

- Acquisition - enhance the form-filling experience by making it more engaging and providing clearer explanations of unfamiliar financial terms

- Financial Analysis - enhance the client meeting experience by refining interfaces—such as charts, printouts and the sales dashboard—to deliver better sales data for better competition engagement

- ACT - update form layouts and enhanced data collection methods to shorten the length of the form

- Define

Selecting main areas of focus for the financial analysis revamp based on the research and ideation phase:

Improved data visualisation for the dashboard to engage sales staff. Easier for users to read and understand at a glance.

Problem #1

Clearer data visualisation for the client facing experience. Optimise client data displays with better labelling and UI feedback for selected sections.

Problem #2

Improvements to the staff facing dashboard

Sharper data visuals that reveal key trends to boost sales performance

Improvements to the main FNA screen

Clearer labelling and visual indicators for selected sections for client facing screens

Next steps

To advance this development phase, I will conduct usability testing with Financial Planners to validate the effectiveness of these proposals. Following this, we will proceed with iterative refinements and further development. This structured approach will drive meaningful improvements in client engagement and sales performance during the next evolution of the Acquisition and Financial Analysis stage.

HSBC BankPinnacle Wealth Planning

Senior UX Designer

Wealth planning for the ultra rich

Tapping into mainland China with the promise of quality investments backed by foreign banks

Overview

In 2020, HSBC seized an opportunity to expand into mainland China’s wealth management market by launching Pinnacle Venture—a bespoke insurance and investment platform. After acquiring full ownership of its joint venture, HSBC started on its plan to grow its portfolio of high-net-worth Non-Resident Chinese (NRCs) - riding on their track record of trustworthy foreign-backed, long-term wealth solutions.I was one of an in-house team of six global designers (Hong Kong/Guangzhou based) working alongside five other mainland China designers (Shanghai based) who were brought onboard to help create an E2E journey that consisted of three main parts:

- Acquisition (on/off-site events/referrals/WeChat integration),

- Financial Analysis and Recommendation (engagement and analysis)

- ACT (Application process).

The key user journeys I owned within the UX team were:1. Acquisition - Designed the sign-up experience to convert prospects into Pinnacle clients2. Financial Analysis & Recommendation - Crafted the post-meeting journey where Financial Planners analyse client needs and generate tailored wealth plans

Role:

UX/UI Designer

User research

System audit

Prototyping

Team:

3 Product ownersSolution architectFull stack devs

Software testersStakeholders

Duration:

6 months

Pinnacle E2E journey

The three phases of the Pinnacle program starting from offsite/online events through to the application process

Acquisition

- Offsite/Online events

- EDM

- Official WeChat account

- 2 x WeChat Mini Programs

Financial Analysis

- Engagement

- Analysis

- Proposal

- Financial Analysis report

ACT

- EKYC

- Application form

- Underwriting

- Payment

- Discover

Research and feedback revealed these key issues:After the initial MVP launch, feedback for all three stages of the E2E journey had met with the following issues:

- Acquisition - The form was too long and text heavy. It was also overly complicated to fill in especially during online events where the FP wasn’t readily available

- Financial Analysis - The charts were difficult to read and understand with unintuitive interface. The data on the dashboard also wasn’t targeted and didn’t encourage competitiveness within the team.

- ACT - The process was too long and involved much repetitive inputs such as asking for the addresses numerous times within the same form

Redesign Goals

To improve the overall experience of the E2E journey by:

- Acquisition - enhance the form-filling experience by making it more engaging and providing clearer explanations of unfamiliar financial terms

- Financial Analysis - enhance the client meeting experience by refining interfaces—such as charts, printouts and the sales dashboard—to deliver better sales data for better competition engagement

- ACT - update form layouts and enhanced data collection methods to shorten the length of the form

- Define

Selecting main areas of focus for the financial analysis revamp based on the research and ideation phase:

Problem #1

Improved data visualisation for the dashboard to engage sales staff. Easier for users to read and understand at a glance.

Problem #2

Clearer data visualisation for the client facing experience. Optimise client data displays with better labelling and UI feedback for selected sections.

Improvements to the staff facing dashboard

Sharper data visuals that reveal key trends to boost sales performance

Improvements to the main FNA screen

Clearer labelling and visual indicators for selected sections for client facing screens

Next steps

To advance this development phase, I will conduct usability testing with Financial Planners to validate the effectiveness of these proposals. Following this, we will proceed with iterative refinements and further development. This structured approach will drive meaningful improvements in client engagement and sales performance during the next evolution of the Acquisition and Financial Analysis stage.